ASP – Average Sales Price. The Average Sales Price is a formula used by Medicare to determine the price of a medication used under the medical benefit of Medicare. The Average Sales Price is the Average Drug Price sold to all purchasers, excluding certain purchasers.

What does the ASP include and exclude in its calculation?

The Average Price includes volume discounts, prompt pay discounts, cash discounts, free goods contingent on purchase requirements, chargebacks, and rebates. [1] However, sales that are less than 10% of the average manufacturer price,[2] sales to 340B covered entities,[3] drugs provided through patient assistance programs and manufacturer discount programs,[4] taxes and other fees that are passed to the purchasers,[5] and international sales[6] are not counted towards the ASP.

What drugs are covered?

ASP applies to drugs administered under the medical benefit (part B). A couple of factors determine whether Part B covers a drug. First, purchasing the drug must be reasonable and necessary for diagnosing or treating an illness or injury. [7] Medicare Part B covers drugs based on their type, route of administration, location of administration (office or home), and diagnosis.[8] Generally, these drugs are administered in a physician’s office and not self-administered.[9]

What are manufacturers’ responsibilities for the ASP?

Manufacturers must report data to CMS quarterly. Manufacturers must report average sales price data quarterly.[10] Manufacturers submit price concessions that include Volume discounts, Prompt pay discounts, Cash discounts, free goods contingent on any purchase requirement, Chargebacks, and rebates (other than rebates under the Medicaid program).[11] Bona fide service fees are not considered price concessions and do not count towards calculating the ASP.[12] Bonafide service fees are i) fair market value, ii) itemized to the service performed, iii) a service the manufacturer would otherwise perform, and iv) not passed through to clients or customers.[13] Although manufacturers have requested clarity on what categories of payments qualify as bona fide service fees, it seems that distribution service fees, inventory management fees, and fees associated with patient care programs like medication compliance programs and patient education programs are generally accepted as bona service fees.[14]

Why is this important?

ASP is important for multiple reasons. CMS reimburses providers for the acquisition of qualifying drugs based on the ASP. Providers are compensated based on the drugs’ Average Sales Price (ASP), with an additional 6% to account for administration, storage, overhead costs, and a compensation rate.[15] The compensation rate represents a profit margin, a critical revenue stream for many providers.[16] An extreme example is a drug that has an ASP of $100, which will result in the provider getting $6 in profit. If a drug with a similar clinical profile costs $1000, the provider would receive $60 in profit. A reduced ASP would reduce providers’ compensation rates and lessen the incentive to use such products. This adjustment incentivizes providers to favor the prescription of higher-cost drugs, which produces a more significant rebate. Consequently, this shift in provider incentives may undermine the anticipated savings from a drop in ASP for the reduced utilization of a cost-effective drug.

Examples of ASP.

Determining ASP is a delicate balance. Xolair is one of many places where the list price and ASP vary. The list price (cost without insurance) of 300mg of Xolair varies but is around $2,936 monthly.[17] However, Xolair’s ASP is $37.755 per 5 mg; 300mg would result in an ASP of $2,265.30 per month.[18] Xolair has a 20% difference between the list price and the ASP. This means two things. On average, Xolair gives customers around a 20% discount. Second, 300mg of Xolair would result in a 2,341.20 reimbursement to the provider, leaving the provider with 75.90$ profit per month.

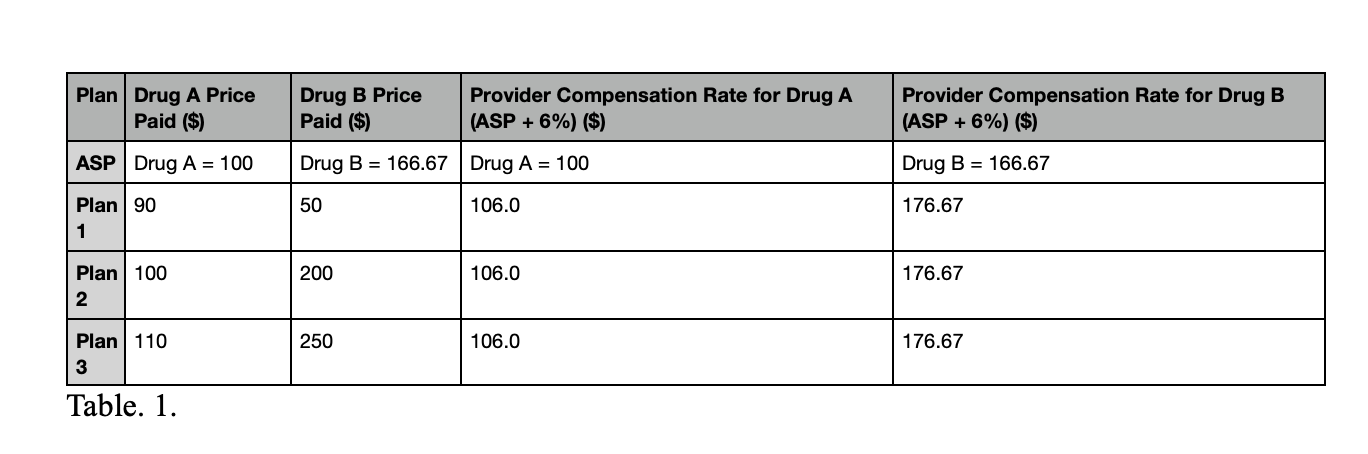

A hypothetical example further reinforces this idea. Let’s say Drug A’s list price is $100. Drug A sells to Plan 1 for $90, Plan 2 for $100, and Plan 3 for $110. Drug B’s list price is $200. Drug A sells to Plan 1 for $50, Plan 2 for $200, and Plan 3 for $250. This example shows that the ASP for Drug A is $100[19] where the ASP for Drug B is $166.67.[20] Providers would profit $6 for Drug A and $10 for Drug B. Providers are incentivized to use Drug B despite the more significant cost to CMS.

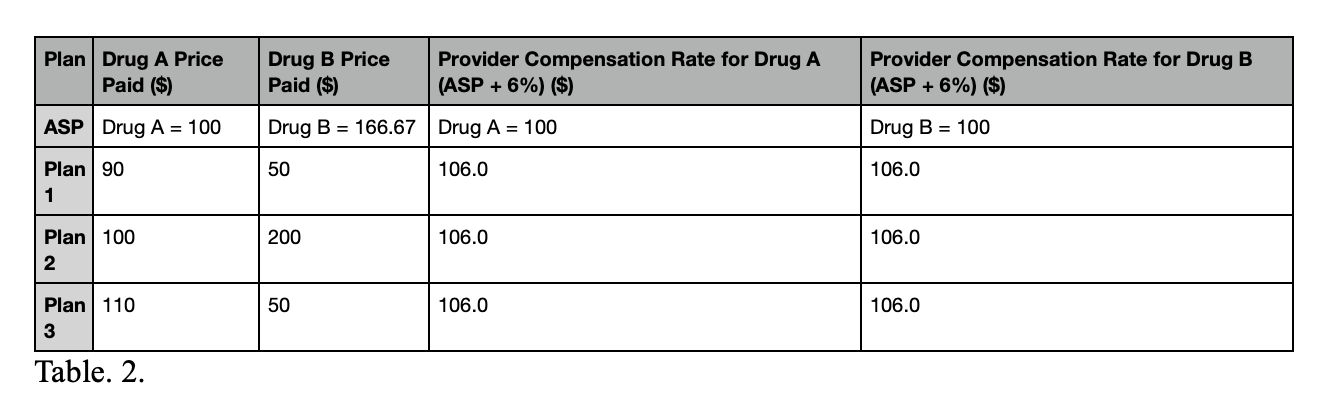

If plan 3 uncovers one price for drug B, and drug B’s price is dropped to match plan 1, this price concession alters the calculation. Drug B’s ASP drops and is now $100[21] and providers are now compensated only $6 compared to the $10 before the price concession.

Conclusion

Calculating ASP and managing price concessions require a careful calculation for manufacturers. A lower ASP can reduce provider utilization of cost-effective drugs, leading to lower manufacturer profits and potential shifts toward higher-cost alternatives. On the other hand, higher ASPs may result in restrictive formularies, limited patient access, and higher out-of-pocket costs. Manufacturers must navigate these dynamics to ensure sustainability while promoting patient access to affordable medications.

Important Drug Pricing Terms Read on Substack

[1] 42 U.S.C. 1395w–3a (2)(C)(3)

[2] 42 CFR § 414.804(a)(3):

[3] 42 CFR § 414.804(a)(4):

[4] CMS Medicare Claims Processing Manual, Chapter 17, Section 20.1

[5] 42 CFR § 414.804(a)(1):

[6] 42 CFR § 414.804(a):

[7] MedPAC, Payment Basics: Medicare Part B (2024), https://www.medpac.gov/wp-content/uploads/2024/10/MedPAC_Payment_Basics_24_PartB_FINAL_SEC.pdf.

[8] Id.

[9] See Id. (In addition to physician-administered drugs, preventative vaccines, pharmacy-supplied drugs like oral cancer drugs and immunosuppressive drugs, inhalation drugs that require administration with a Part B nebulizer, certain home infusions drugs like certain intravenous drugs for heart failure and pulmonary hypertension, and clotting factor drugs.)

[10] 42 U.S.C. § 1395w-3a(c)(2)(A). 2 CFR § 414.804. (Manufacturers calculate the ASP for each calendar quarter and submit it to CMS within 30 days of quarter end. CMS then uses the submission to calculate the ASP for 2 quarters in the future (Q1 submission is implemented as the Q3 ASP).

[11] 42 CFR 414.804(a)(2)

[12] 42 CFR 414.804(a)(2)(ii)

[13] 42 C.F.R. § 414.802. boa42 CFR § 447.502. The first two requirements mean that the fee must be within a market price (not exceptionally large or small), and the service fee needs to be itemized with proper documentation. The last two requirements are somewhat confusing. A service that the manufacturer performs is something they have not contracted out, which the manufacturer would have had to perform. Examples of bona fide services include distribution service fees, inventory management fees, managing credit risks, chargeback processing, fees associated with administrative service agreements, and patient care programs like medication compliance and patient education programs. Mintz, Deciphering the Final AMP Rule: Key Provisions Impacting Drug Manufacturers, Insights Center (May 22, 2018), https://www.mintz.com/insights-center/viewpoints/2146/2018-05-22-deciphering-final-amp-rule-key-provisions-impacting. Absent of a manufacturer contracting with a distribution service, the manufacture would have to perform the tasks.

[14] Mintz, Deciphering the Final AMP Rule: Key Provisions Impacting Drug Manufacturers, Insights Center (May 22, 2018), https://www.mintz.com/insights-center/viewpoints/2146/2018-05-22-deciphering-final-amp-rule-key-provisions-impacting

[15] IRA Medicare Part B Negotiation Shifts Financial Risk to Physicians, Nov. 29, 2022, Avalere, https://avalere.com/insights/ira-medicare-part-b-negotiation-shifts-financial-risk-to-physicians

[16] Id.

[17]Xolair Prices, Coupons and Patient Assistance Programs, Drugs.com, https://www.drugs.com/price-guide/xolair (Jan.20, 2024). The List Price for Xolair, Biologic Meds, [https://biologicmeds.org/approved-biolog

[19] (90 + 100 + 110) / 3 = $100.

[20] (50 + 200 + 250) / 3 = $167.67.

[21] (50 + 200 + 50) / 3 = $100